October 22, 2025 | 02:57 pm

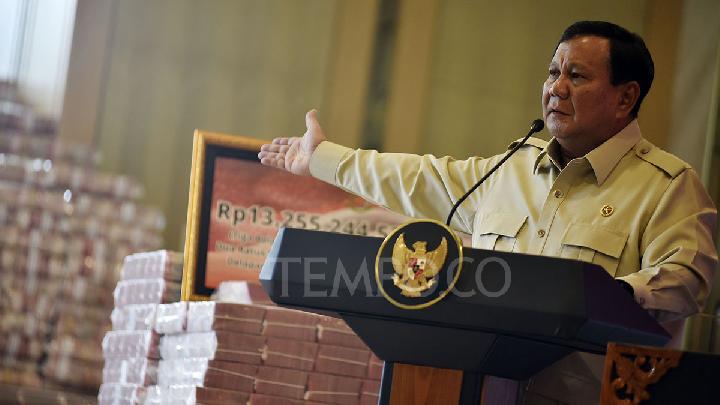

TEMPO.CO, Jakarta - The Chair of Indonesia’s Financial Services Authority (OJK) Board of Commissioners, Mahendra Siregar, said that placing Rp200 trillion in state-owned banks (Himbara) could help drive down banking interest rates.

He explained that the practice of offering special rates, or higher interest rates to large depositors, has long been a major obstacle to lowering lending rates in the banking sector.

Currently, government funds parked in Himbara banks earn an average interest rate of 4.02 percent. Mahendra said this move gives banks greater bargaining power to resist demands from big depositors seeking higher returns.

“With the interest rate set at around 4 percent, banks now have a stronger bargaining position compared to other depositors, who previously demanded higher rates through the so-called special rate scheme,” Mahendra said after meeting with Finance Minister Purbaya Yudhi Sadewa in Jakarta on Wednesday, October 22, 2025.

The special rate refers to preferential interest rates offered by banks to clients who deposit large sums. Mahendra noted that by reducing the government’s deposit rate, banks are less pressured to grant such high returns to other wealthy clients.

This, in turn, could accelerate the decline of overall banking interest rates.

“So, with the interest rate at 4 percent, banks have the leverage not to simply comply with depositors’ demands for higher returns,” he added.

The issue of special rates has also drawn attention from Bank Indonesia (BI). During a hearing with Commission XI of the House of Representatives on September 22, BI Governor Perry Warjiyo highlighted that these preferential rates now account for 25 percent of total third-party funds (DPK), posing a challenge to monetary policy transmission.

“Despite declines in the BI rate and improved liquidity, deposit and lending rates remain high partly because of the widespread practice of special deposit rates,” Perry said, as quoted by Antara.

According to BI data, total deposits earning above the Deposit Insurance Corporation (LPS) guarantee rate reached Rp2,380.4 trillion.

The central bank also noted that the average special rate stood at 6.19 percent in 2024, up slightly from 6.13 percent in 2023.

As of August 2025, the figure was 5.91 percent, showing that the practice, while moderating, remains prevalent in Indonesia’s banking system.

Editor’s Choice: Survey Ranks Finance Minister Purbaya Top Performer in Prabowo's First Year in Office

Click here to get the latest news updates from Tempo on Google News

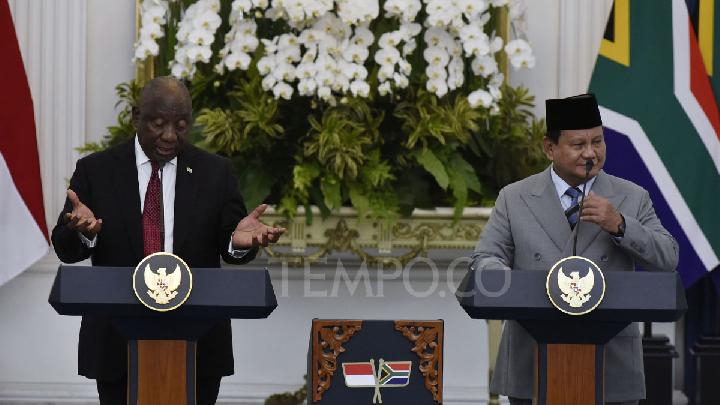

Survey Ranks Finance Minister Purbaya Top Performer in Prabowo's First Year in Office

2 jam lalu

Indonesia Political Opinion conducted a survey on ministers considered to have the best performance in a survey marking the first year of Prabowo's administration.

15 Local Governments in Indonesia with the Biggest Bank Deposits, According to Minister Purbaya

7 jam lalu

According to Purbaya, the allocated funds from the central government to the regions are available and ready to be used to support development in each region.

Indonesia: E-Commerce Tax Implementation Pending 6% Economic Growth

1 hari lalu

Minister of Finance requests postponement of e-commerce tax until Indonesia achieves 6% economic growth.

Indonesia's Finance Minister Purbaya Says "Too Early" to Recalculate VAT Rates

1 hari lalu

Finance Minister Purbaya Yudhi Sadewa stated that it is still too early for the ministry to recalculate the VAT (Value Added Tax) rates.

OJK Says It Saved Rp376 Million from Scam

2 hari lalu

The Financial Services Authority (OJK) in Indonesia stated that they successfully saved money from scams amounting to Rp376.8 billion.

Public Losses from Financial Scams Reach Rp7 Trillion, OJK Reports

3 hari lalu

As of October 16, 2025, OJK recorded 299,237 received reports and 487,378 reported accounts.

Indonesia Offers 6% VAT Discount on Domestic Flights for Holiday Season

4 hari lalu

The government offers a special VAT discount on domestic economy-class flight tickets from October 22, 2025, to January 10, 2026.

Indonesia's Purbaya Says Market Fluctuations Benefit Investors

4 hari lalu

Minister of Finance Purbaya Yudhi Sadewa emphasized the importance of a fluctuating stock market to benefit investors.

Indonesia's OJK Confirms Danantara's Patriot Bonds Ready for Issuance

4 hari lalu

OJK has confirmed that the Patriot Bonds investment instrument, owned by sovereign wealth fund Danantara Indonesia, is ready to be issued.

Indonesia's BGN Rushes to Achieve Optimal Results for MBG Program by Year End

5 hari lalu

BGN Chair, Dadan Hindayana, said the MBG budget absorption is proportional to the number of beneficiaries.

:strip_icc():format(jpeg)/kly-media-production/medias/3110450/original/059507500_1587634731-Praying_Hands_With_Faith_In_Religion_And_Belief_In_God__Power_Of_Hope_And_Devotion___1_.jpg)

:strip_icc():format(jpeg)/kly-media-production/medias/5264803/original/026336600_1750904581-Cek_Fakta_Tidak_Benar_Ini_Link_Pendaftaran__11_.jpg)

:strip_icc():format(jpeg)/kly-media-production/medias/5255933/original/074636900_1750220645-Desain_tanpa_judul__6_.jpg)

:strip_icc():format(jpeg)/kly-media-production/medias/904568/original/070887100_1434622909-imagepemimpinresized.jpg)

:strip_icc():format(jpeg)/kly-media-production/medias/5263442/original/009790100_1750822278-Cek_Fakta_Tidak_Benar_Ini_Link_Pendaftaran__2_.jpg)