TEMPO.CO, Jakarta - Co-payment insurance will burden the people. Putting right the management of insurance and hospitals is far more urgent.

BY implementing the joint liability, or co-payment, scheme between policyholders and insurance companies, the Financial Services Authority (OJK) is passing the buck. Instead of monitoring how insurance companies invest or grow the funds they manage, the institution has passed on the burden to policyholders by obliging them to pay part of their claims.

This co-payment obligation is ruled in OJK Circular No. 7/2025 on Health Insurance. Under the scheme, which comes into force in 2026, holders of health insurance policies will have to pay at least 10 percent of any claim they make. This obligation will apply to outpatient and inpatient services, with a maximum value of Rp300,000 for outpatient treatment or Rp3 million for inpatient care. Insurance companies can increase the maximum payment subject with the agreement of policyholders.

This means that the OJK wants to reduce the burden on insurance companies caused by shrinking the difference between premium revenue and claim payments. For example, in 2021, the difference between premiums and claims was Rp4.46 trillion. For 2022 and 2023, the difference fell to Rp1.53 trillion and Rp650 trillion, respectively. These lower surpluses were the result of medical inflation, or an increase in health costs, which was around 9 to 10 percent during that period.

Conversely, the investment returns for insurance companies declined. From January to March 2024, the total investment returns for insurance companies totaled around Rp3.5-12 trillion. But in the same period this year, the total was only Rp1.62 trillion. And in February 2025, the value was minus Rp6.043 trillion. The low income from investments has had an impact on the ability of insurance companies to deal with the pressure from continually increasing claims.

And this is where the problem lies. The collapse of investment returns is related to the way insurance companies have managed premium funds. Although it is undeniable that the gloomy state of the financial markets over the last few years has had an impact on investment revenues, it should have been possible to anticipate this through hedging or investing in less risky portfolios like government bonds.

Another key factor that has been ignored in this policy is the fact that many insurance companies have fallen into the trap of putting their money into programmatic investment instruments because their directors have been tempted by bribes. The problems with Asuransi Jiwasraya and Asuransi Angkatan Bersenjata Republik Indonesia (Asabri) have shown that those managing insurance funds are easily persuaded by investment managers offering bogus assets in return for commissions.

Ultimately, policyholders pay the price. It is fair to suspect that the co-payment scheme is a way for the insurance companies to pass the burden resulting from their mistakes on to policyholders. And the OJK also seems to be avoiding accountability for its poor oversight of the management of insurance investments.

Another aspect that should be monitored closely is the conduct of crooked managers of hospitals and clinics. There have been many cases of over-claims for services that patients did not actually need, but that were arranged by doctors or hospital managers in order to increase profits. And the continuing medical inflation is probably driven by these actions, given that policyholders and patients are in a much weaker position than hospitals when it comes to the provision of health services.

The OJK and the government should put these problems right before implementing the co-payment scheme. The public must not be burdened by problems that were caused by the mismanagement of insurance companies and hospitals.

OJK Receives 153,000 Financial Scam Reports

1 hari lalu

The OJK has received over 153,000 financial fraud reports with victims suffering trillions of rupiah in losses.

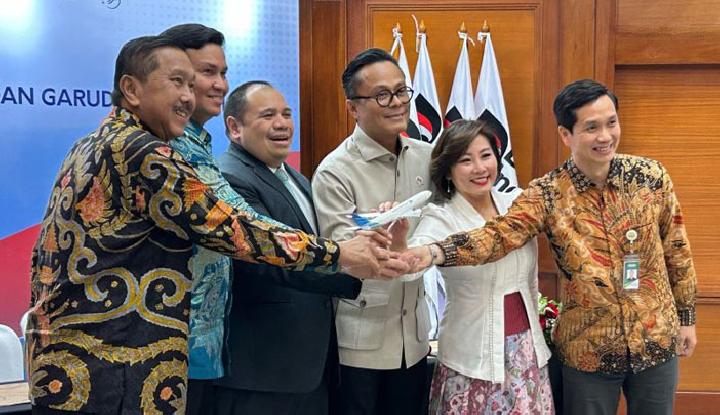

Danantara Injects Rp6.65tn in Capital into Garuda Indonesia via Shareholder Loan

1 hari lalu

Danantara's initial fund injection for Garuda Indonesia is earmarked for maintenance, repair, and overhaul (MRO) needs.

Cryptocurrency Regulations in Singapore: How Do They Compare Globally?

1 hari lalu

Singapore just updated its cryptocurrency regulations, with new rules taking effect on June 30. How do these compare to those in other countries?

Bank Indonesia Records Rp2.04 Trillion Capital Outflow in One Week

5 hari lalu

Bank Indonesia reported that foreign capital outflow from Indonesia on June 16-19, 2025, amounted to Rp2.04 trillion.

World Bank Grants Yemen $30 Million to Support Education and Digital Payments

5 hari lalu

In addition to Indonesia, the World Bank injects a US$30 million grant for Yemen. What is it for?

Government Responds to Indonesia's Declining Competitiveness Ranking

5 hari lalu

The World Competitiveness Ranking announced that Indonesia's competitiveness dropped 13 ranks in 2025.

Danantara Boss Pledges Job Creation as Agency's Top Priority

6 hari lalu

In the midst of layoffs occurring in Indonesia, Danantara has stated that job creation is their priority.

Dubai's EDGNEX to Invest US$2.3bn in Indonesian Data Center Construction

6 hari lalu

The investment will be used to build a modern data center infrastructure on a 12-hectare land in the Cikarang industrial area.

World Bank Approves US$2.1bn Investment Package for Indonesia; Here's the Detail

6 hari lalu

The World Bank has approved two large investments to create jobs, boost economic growth, and improve access to clean energy throughout Indonesia. What are the allocations?

Daniel Radcliffe's Net Worth 2025: From Harry Potter to Millionaire Actor

7 hari lalu

Rising to fame at just the age of 12, discover Daniel Radcliffe's net worth in 2025 which he built through a successful acting career.

:strip_icc():format(jpeg)/kly-media-production/medias/4792086/original/012724000_1712058267-424435769_351377641151306_6011777831034403281_n.jpg)

:strip_icc():format(jpeg)/kly-media-production/medias/5260778/original/098870200_1750640493-Cek_Fakta_Tidak_Benar_Ini_Link_Pendaftaran__9_.jpg)

:strip_icc():format(jpeg)/kly-media-production/medias/5264803/original/026336600_1750904581-Cek_Fakta_Tidak_Benar_Ini_Link_Pendaftaran__11_.jpg)

:strip_icc():format(jpeg)/kly-media-production/medias/3110450/original/059507500_1587634731-Praying_Hands_With_Faith_In_Religion_And_Belief_In_God__Power_Of_Hope_And_Devotion___1_.jpg)

:strip_icc():format(jpeg)/kly-media-production/medias/4179793/original/078924100_1664858590-Lesti_Kejora_1_4_Juta_31_Agustus.jpg)

:strip_icc():format(jpeg)/kly-media-production/medias/5255933/original/074636900_1750220645-Desain_tanpa_judul__6_.jpg)

:strip_icc():format(jpeg)/kly-media-production/medias/904568/original/070887100_1434622909-imagepemimpinresized.jpg)